How Do Self-Employed Individuals Get SSDI Benefits?

If you have become injured or ill and you are expected to be unable to work for at least 12 months, you may be eligible for Social Security Disability Insurance (SSDI). Applying for benefits can be tricky for anyone, if you are self-employed, you may have additional concerns. After looking into benefit options, you may wonder can you get SSDI if you are self-employed?

In this article, we will break down the requirements and details of qualifying for SSDI benefits when you are self-employed.

Types of jobs that are considered self-employment include:

Types of jobs that are considered self-employment include:

- Freelance work

- Owning a small business

- Independent contracting

- Gig economy jobs

- Home-based businesses

Requirements

You are able to receive SSDI benefits if you meet the criteria laid out by the Social Security Administration (SSA). There are a few extra steps needed if you are self-employed and need benefits.

To qualify for SSDI benefits, you generally need 40 work credits, with at least 20 earned in the 10 years leading up to the start of your disability.

Work credits are based on your wages, and you can earn up to four credits per year. In 2025, you can earn one credit for each $1,810 you make.

The amount of work credits you need to be eligible depends on your age when you became disabled.

Self-employed individuals pay into Social Security through SECA (Self-Employed Contributions Act) taxes. Non-self-employed individuals pay FICA (Federal Insurance Contributions Act) taxes, a similar payroll tax. Both of these laws require that taxes are withheld from paychecks to fund Social Security and Medicare programs.

Self-employed individuals pay into Social Security through SECA (Self-Employed Contributions Act) taxes. Non-self-employed individuals pay FICA (Federal Insurance Contributions Act) taxes, a similar payroll tax. Both of these laws require that taxes are withheld from paychecks to fund Social Security and Medicare programs.

FICA taxes are split equally between the employee and the employer, whereas under SECA, those who are self-employed pay both the employee and the employer share.

The SSA will look at the following when determining the outcome of your claim:

- Medical records

- Income records

- Work activity records

Substantial Gainful Activity

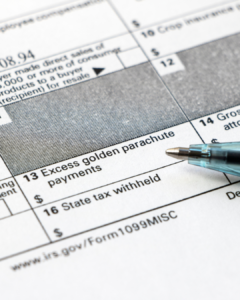

The SSA will look for proof of income by evaluating your:

- Bank statements

- Tax returns

- 1099 forms

- Business records

The SSA will evaluate your Substantial Gainful Activity (SGA) when reviewing your application for SSDI benefits. SGA is the monthly amount of earnings an individual can make and still qualify for benefits. In 2025, the SGA amount is $1,620. However, the rules for SGA for self-employed individuals are a bit different. It is not based solely on income; the SSA also considers the type of work you do and the impact it has.

Even if you earn under $1,620 per month, the SSA will look closely at your self-employment activities when reviewing your claim.

The SSA looks at these areas:

- Countable Income – net earnings a self-employed person makes annually after deducting business expenses

- Significant Services– the significance of your work combined with how you substantial your income is

- Comparability of Work – the industry equivalent of non-self-employed individuals in a similar industry

- Worth of Work – how the service, skill, and job task are valued and how much weight it has in the business

Legal Representation

It is normal to find the SSDI process as a self-employed individual complex and hard to navigate on your own. Hiring a disability lawyer is recommended to help ensure you are following the rules and increase your chances of approval. They will file necessary paperwork on your behalf, review your application for errors or needed details, and represent you if your case goes to hearing with an Administrative Law Judge.

Fierce Advocacy

At Nyman Turkish, our team includes some of the highest-rated disability attorneys in the country. As a recognized leader in disability law, our firm consistently achieves approval rates well above the national average. Our experienced attorneys, legal assistants, and case managers are dedicated professionals who bring deep knowledge and compassion to every case. We treat each client with the individual attention they deserve, setting us apart from other firms. We know this can be one of the most challenging times in your life, and we’re here to support you at every step.

If you need help filing an SSDI claim and are self-employed visit our website or call (877) 529-4773 for a FREE case review.